Finding Auto Insurance High Risk Drivers Can Afford

Although high-risk drivers may no longer qualify for standard insurance policies and rates, it does not mean that they have been priced out of driving all together. Thankfully, high-risk drivers have several ways for finding auto insurance they can afford.

Although high-risk drivers may no longer qualify for standard insurance policies and rates, it does not mean that they have been priced out of driving all together. Thankfully, high-risk drivers have several ways for finding auto insurance they can afford.

Search for affordable high-risk insurance now by entering your ZIP code into the FREE box!

Since owning a car can be very expensive, the last thing most people need is to pay higher insurance rates. Although being declared a high risk to insure can be unsettling, if you follow these tips, you will find some reasonable coverage for your vehicle.

High Risk Classification

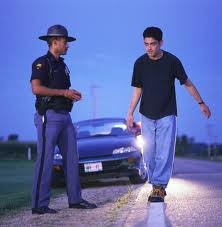

There are no set rules as to why someone is declared a high-risk driver. Typically, it is done because an insurance provider believes a driver could cost them a lot of money if they insure them. Carriers determine their rates by spreading risk among several people, but having people with a considerable likelihood to need the coverage can taint the pool of risk. As a result, the company may decline to insure the driver.

Usually, high-risk drivers have caused a couple of accidents or they have received several traffic violations. For example, they may have been responsible for a car crash and were caught speeding several times.

Usually, high-risk drivers have caused a couple of accidents or they have received several traffic violations. For example, they may have been responsible for a car crash and were caught speeding several times.

Because of this bad driving record, a provider is leery about insuring their car, since they have consistently demonstrated high-risk behavior behind the wheel.

You could be declared a high-risk driver even if you do not have a bad driving record.

Sometimes, very inexperienced drivers are declared high risk even though they have not been involved in any traffic incidents. In addition, a provider may determine that a driver over the age of 70 poses a high risk to insure.

Although it is less common, some people are declared high-risk drivers for reasons that have nothing to do with driving. For example, if you live in a neighborhood with a lot of crime and your car gets broken into repeatedly, a provider may conclude you are a high risk to insure.

Although it is less common, some people are declared high-risk drivers for reasons that have nothing to do with driving. For example, if you live in a neighborhood with a lot of crime and your car gets broken into repeatedly, a provider may conclude you are a high risk to insure.

Depending on your circumstances, if you drive a very expensive car that thieves particularly target, a company may also assign a high-risk classification.

In addition, if you have had your insurance policy canceled due to non-payment, providers could see you as a high risk to insure. If an insurance company believes it may not get the money you owe them, it may decide you represent too great of a risk to insure.

Non-Standard Insurance

Once an insurance company classifies someone as a high-risk driver, typically they will not be offered an insurance policy with standard rates. As a result, they are only eligible for high-risk insurance, or “non-standard insurance,” which is usually more expensive.

The Texas Department of Insurance notes that high-risk customers, on average, can receive premium bumps as high as 60%.

It is more expensive because the provider believes the driver is likely to file an insurance claim.

Many companies offer non-standard insurance policies. Some major providers offer coverage to high-risk drivers and there are companies that specialize in selling non-standard-insurance.

As long as you are legally permitted to drive, nearly every state ensures that drivers can buy coverage for their car, high risk or not. For example, California’s Department of Insurance manages a program that helps drivers get affordable coverage. The program requires proof of income eligibility. In Indiana, the Department of Insurance requires providers to insure their fair share of high-risk drivers.

As long as you are legally permitted to drive, nearly every state ensures that drivers can buy coverage for their car, high risk or not. For example, California’s Department of Insurance manages a program that helps drivers get affordable coverage. The program requires proof of income eligibility. In Indiana, the Department of Insurance requires providers to insure their fair share of high-risk drivers.

SR-22

Many states require high-risk drivers who have been convicted of a serious driving offense to file an SR-22 or 21 form. These documents verify that a driver has purchased the amount of insurance they are required to have.

For example, a driver that has been convicted of driving under the influence may have to file an SR-22 so that they can legally drive. Drivers who have had their license suspended or revoked may also need to file one of these forms.

When an SR-22 expires, insurance providers are required to inform the state department that is responsible for overseeing them. In Tennessee, this entity is the Department of Safety & Homeland Security; in Colorado, it is the Department of Revenue.

Improve Your Driving Profile

An effective way to improve your chances of finding affordable high-risk insurance is to improve your driving record. If a high-risk driver continues to rack up speeding tickets or causes another accident, their rates could rise dramatically. On the other hand, if they drive safely and do not receive any more tickets, then gradually, their driving record will improve.

Taking driving lessons is a great way to improve your driving profile. Insurance providers believe that people who complete driving courses are better drivers, and as a result, many offer discounts to people who have taken them.

Even if you have taken classes in the past, enrolling in courses for mature drivers is a good way to show providers you are serious about driving better.

You should also inquire with your state department to make sure that any unpaid tickets or fines have been paid. Any outstanding violations on your driving record will make your insurance rates go up. You can also ask if older fines can be removed from your record.

Buy an Inexpensive Car

If you want to find affordable non-standard coverage, do not drive an expensive car. Valuable vehicles cost much more to fix; even simple repairs can cost thousands of dollars. As a result, insurance companies will charge much more to insure them.

If you want to find affordable non-standard coverage, do not drive an expensive car. Valuable vehicles cost much more to fix; even simple repairs can cost thousands of dollars. As a result, insurance companies will charge much more to insure them.

Flashy and pricey cars are also more likely to be stolen or broken into. Providers charge higher rates to cover them, regardless of whether they belong to a high-risk driver or not.

Drive a Safe Vehicle

Driving a vehicle that has great safety ratings and features is another good way to lower your premiums. Providers are concerned about incurring costly damage when they insure high-risk drivers. Driving a safe car that avoids serious accidents more often will reduce their fears and your insurance rates.

You can find out which vehicles have excellent safety ratings by referring to the U.S. Department of Transportation’s Safercar website.

You can find out which vehicles have excellent safety ratings by referring to the U.S. Department of Transportation’s Safercar website.

It is also important to remember that insurance companies do not like to see high-risk drivers operating high-performance vehicles that go extremely fast.

Instead, providers prefer to see high-risk drivers behind the wheels of safe, average cars, which are not as likely to be involved in a high-speed crash.

Choose Your Insurance Carefully

Due to the costly damage that car crashes can cause, every driver should carry a good amount of liability coverage. This kind of coverage helps pay for medical bills or repairs that arise from an accident you cause. Not having enough liability insurance could ruin you financially if you cause a serious accident.

Choose your coverage carefully and seriously consider obtaining collision and comprehensive insurance. If you drive an older and less valuable vehicle, you may not need as much coverage.

Choose your coverage carefully and seriously consider obtaining collision and comprehensive insurance. If you drive an older and less valuable vehicle, you may not need as much coverage.

Collision insurance will pay for repairs your car needs in an accident you cause. If you drive an expensive vehicle, you will need a good amount of collision insurance. If you own an old vehicle, however, the cost of repairing it might not be that much.

The same can be said for comprehensive insurance, which pays for damage your car incurs from an act of nature or a non-motorist. For example, if your car is dented during a tornado, then comprehensive insurance will cover the repairs.

If you rarely drive your car at all, then you could be eligible for a low-mileage policy, which will help reduce your rates. Insurance providers can offer lower rates to people who do not drive much because, statistically speaking, they are less likely to be involved in an accident.

The eligibility requirements for low-mileage policies differ depending on the company.

Increase Your Deductible

If you are certain you will have the money if you need it, then raising your deductible will in turn lower your premium. The deductible is how much you are required to put toward the cost of an insurance claim.

For example, if you agree to an $800 deductible, you will pay that toward the damage and your insurance provider will pay the rest. The higher your deductible, the less your provider has to pay, and the lower your rates will be.

Compare Insurance Providers

Regardless of whether you are a high-risk driver or not, by shopping around, you could save some big money. Plenty of insurance companies are always looking for more business.

Search online to find out which ones provide quality customer service and then see what kinds of deals they offer. Then see if they will match or beat their competitors’ rates.

The best way to do this is to use a website that specializes in comparing insurance quotes. Once you have answered a couple of quick questions, these sites will send you quotes from all the major providers.

Find affordable auto insurance for your car now by entering your ZIP code into the FREE box right here!